Students track effects of COVID-19 on stock market

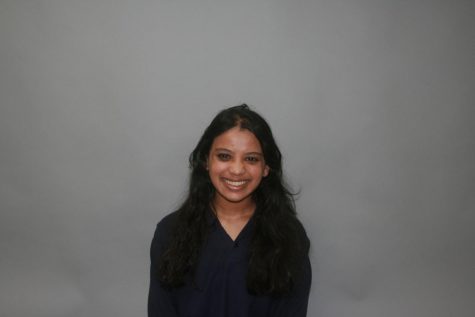

Eighth grader Arjun Maitra stresses over the massive stock market crash. Student traders have been adapting their investment strategies amid the outbreak.

March 26, 2020

Barely 12 weeks after the initial outbreak, COVID-19 has spread to 155 countries. The world is grappling with not only a public health crisis, but an economic one. Coronavirus has implications far beyond health.

In the past three weeks, the U.S. stock market has taken a battering, with the Dow Jones index dropping 3000 points on March 16, the single largest drop in history.

Students who own stocks are still struggling to grasp this economic catastrophe instigated by the coronavirus outbreak. Just as the extreme public health impact of coronavirus was unprecedented, so was the stock market crash.

Several other students have suffered profound losses to the stock portion of their portfolio in the past few weeks. Sophomore Josh Siegel’s assets lost roughly 30 percent of their original value over the last three weeks. Senior Clara Moore, who shares a stock portfolio with her parents, also lost 30 percent of her portfolio.

“The most shocking thing to me [about the crisis] was probably just how fast it crashed,” Moore said. “It’s kind of crazy to watch over 30 percent of your money in the market vanish in four weeks.”

While the speed of the decline of the market was shocking to some students, the magnitude was not unexpected. Junior and long-term investor David Hindman was not surprised at the enormity of the economic losses, but rather, how quickly the market dipped.

Hindman believed the market would decline ever since the turbulent Russia-Saudi oil price war emerged in October. The Federal Reserve subsequently cut interest rates to stimulate an economic boom during a period of overall growth in the market.

“The market has been artificially high for a while now, and a decline was inevitable,” Hindman said. “Although I’d been expecting a drop for a while, I was not accounting for the drop caused by the dispute between Russia and Saudia Arabia over oil. It was so much faster than I thought it would be.”

Some students have taken precautionary measures in the early stages of the financial crisis. For example, a freshman, who asked not to be identified, ended up selling about a quarter of his assets to prepare for the crash and alleviate his losses.

“Even then, I lost a lot more than what I was expecting,” he said. “It was a huge disaster.”

Junior Aiden Manji also sold some of his assets in the wake of the meltdown. Manji said he exercised adequate pragmatism, considering the frenzied panic proliferating among those invested in the economy. With his assets under an enormous amount of pressure, he had no other option.

Students are also carefully considering how they will handle their assets in the near future. Hindman describes himself as a “low risk” trader. He is currently invested in large companies that he believes “are not in that much danger of going bankrupt.” He approaches his investments with a broad perspective.

“I’m just looking out for an opportunity to jump into the market again right before it recovers when the prices are around what I think they should be,” Hindman said.

Siegel plans to strictly adhere to one of the fundamental tenets of investment: buy low, sell high.

“My plan is to hold on to the stock I have and invest more when the market has reached near its lowest point,” Siegel said.

One sentiment that drives some student investors to make their economic decisions is the inherent inconsequentiality of any major losses to their portfolio since the economic health of teenagers does not depend on the economic health of the stock market.

Siegel started investing due to his budding interest in economics, which gradually morphed into a desire to raise funds for charity and gain financial autonomy. For students like him, investing is an interest rather than a livelihood.

Students who invest are in a unique position, according to Manji. Most high school students who invest in the stock market do not rely on monetary gain from investments to maintain basic necessities.

“Since I have no risk — in the sense that if the money was lost it wouldn’t be a big deal — I am in the unique position to go into more high-risk options which also yield much higher rewards,” Manji said.

Most adults investing for retirement tend to choose safe companies that pay out healthy dividends and already have high market value, according to Siegel. This is due to the assurance of low risk coupled with a guaranteed profit. Students have more freedom to invest in risky companies and emerging startups whose financial futures are somewhat nebulous.

Siegel’s risky investments have suffered tremendously from the crash, while his safer investments have emerged almost unscathed in comparison.

“While some small companies I had invested in initially lended themselves to large growth previously, some of their stock values have plunged by over 80 percent because of coronavirus,” Siegel said. “But my large companies have only lost 20 to 30 percent of their value.”

Junior William Sanders engages in a riskier investment strategy: short-term trading. While he describes himself as an efficient predictor of the market, he warns against the high risk of short-term trading.

“It’s crucial to understand that shorting carries immense risk,” Sanders said. “When buying a stock, the most money you can lose is if the stock drops to 0, however, when shorting, the stock can theoretically go to infinity, which would result in infinite losses.”

Sanders has profited tremendously off the volatility of the markets. Since he is a day trader, the state of the market does not directly affect him.

“I profit from intraday movements, not interday,” Sanders said. “So as long as the market is volatile, [like now], I make money.”

Sanders has made more money in the past three weeks than the whole year combined.

Manji said that shorting is negligent during this financial decline, since the economy has already hit near rock bottom.

“I think it’s too late to safely be able to profit off of shorting at this point,” Manji said. “While it was definitely a way to profit, or even hedge, when this all started, the market is at around 18.5 [points] right now, and I don’t see it going down enough to safely short.”

Sanders said that a recession might be looming in the near future. The global pandemic and the inverted yield curve are both indicators of an inevitable recession.

“We are entering one of the worst recessions in U.S. history, perhaps rivaling the 2008 Financial Crisis,” Sanders said. “For a few years, people have been predicting a recession, and the more we push it off, the worse it gets.”

Hindman believes that there will be a global recession, unlike 2008 recession, which was restricted to the United States. A global recession would have profound ramifications on the U.S. economy because it would eliminate the possibility of major foreign aid.

“During the recession of 2007-2009, it was not a global recession, so other countries such as China were not significantly affected and they helped to balance us out,” Hindman said. “This time the whole world is being affected, so there isn’t anything to slow us down.”

According to Sanders, economic theory says that with a recession comes a rebound.

“The market always bounces back after a recession,” Sanders said. “Even after ’08, we had regained all of the losses in only a couple of years.”

Many student investors are putting their faith in a future economic recovery. Moore says that the market will rebound eventually, which is why she has been relatively calm.

“Even though my portfolio is in shambles right now, I keep reminding myself that every bear market or recession rebounds, so I don’t plan on selling anytime soon,” Siegel said.

Hindman agrees, suggesting that the most efficient way to make profit would be to buy at the drop (which he believes to be 10-15% more) and sell after the rebound.

“The best thing to do right now is to wait it out because you don’t want to sell at a loss like this, and the market will rebound,” Hindman said. “After this drop, I would suggest choosing a couple of big companies that you like and buy shares of those companies because the share price will eventually rise back up and you can make a nice profit.”

Some students are concerned that an economic recovery is only possible with the development of a coronavirus vaccine, but Sanders disagrees because “the recession is not just corona-based.”

“The market will, of course, bounce back,” Sanders said. “The U.S. is the strongest, most productive economy on Earth, and growth will continue after the virus and recession end.”